Not many cooperatives offer financing services to their member-owners. But at Valley United, we recognize the important role credit plays in running a modern farm business. And how a professional credit advisor can help our member-owners make the best credit decisions available to them.

At present, we work primarily with two large credit providers: SECURE by Winfield, and John Deere Credit. Our finance team can help you with credit applications, getting your financial statements in order and reviewing all of your financing options. For information about specific programs not listed here, please call our main offices in Reynolds and ask to speak to our finance team.

Valley United Co-op Credit Application

Please print-off and get back to us!

WinField United SECURE started as a pilot program in the Red River Valley (Minnesota and North Dakota) in 2016, at a time when interest rates were starting to rise and financing was getting harder to come by. Since then, the program has grown to more than 2,600 grower loans totaling more than $350 million.

WinField United Secure offers highly competitive financing rates for all seed and crop protection product purchases. The one-page application (for loans of $250,000 or less) are simple and easy to complete. Growers may use these loans to take advantage of pre-pay discounts from manufacturers, including early-order seed purchases.

Below are our forms for new and existing Secure users.

The button below is the direct link for growers to apply for Secure Financing with Valley United Co-op.

Ag Financing That Works As Hard As You Do

With ultra-flexible farm credit that extends to more than 9,000 merchant and dealer locations, your Multi-Use Account will quickly become your single farm financing solution for purchases, including:

- Equipment parts, service & attachments

- Crop seed, protectants & fertilizer

- Livestock feed

- Fuel, including bulk oil and petroleum

- Other general supplies, from gates to gloves

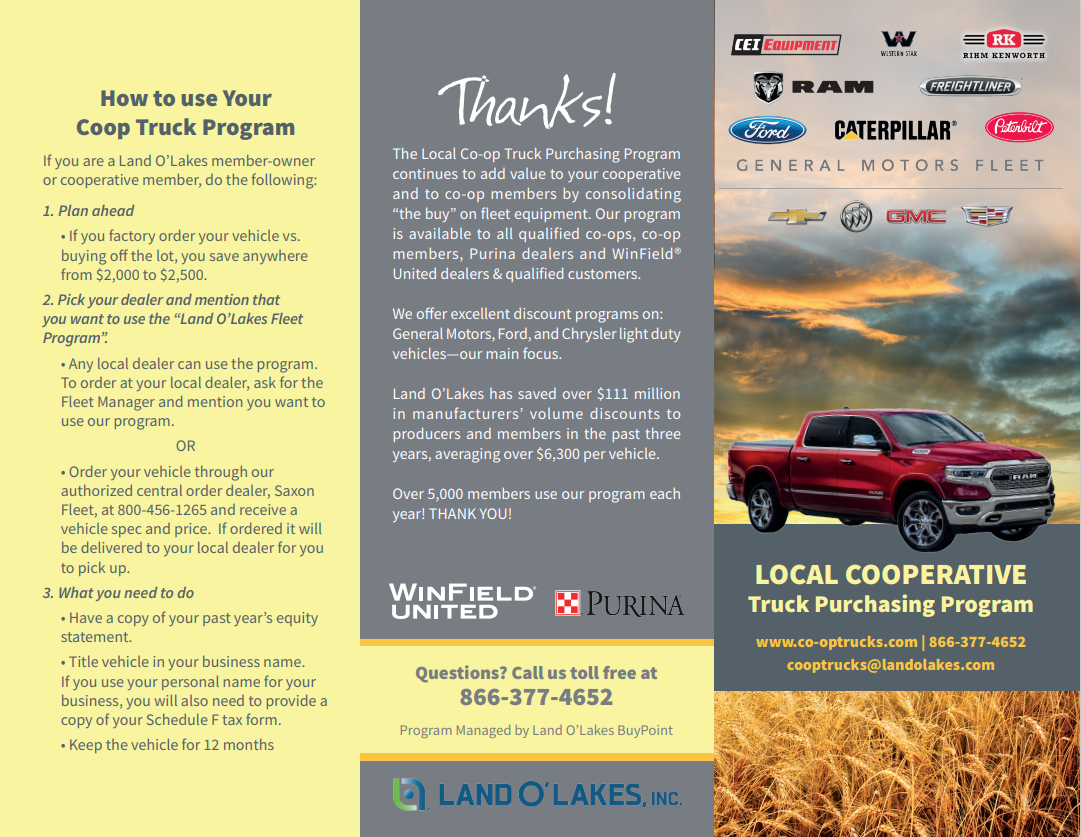

Local Cooperative

Truck Purchasing Program